Author: Norman Frankel, Chief Growth Officer, Stanchion Payments Solutions

Indonesia is a fascinating market with huge retail payments opportunities. Its population of circa 285 million makes it globally the fourth largest country, whilst Jakarta is approaching 12 million people making it the 28th most populous city. An interesting fact is that the country has the largest Muslim population in the world with 87% of her people identifying with the faith. Indonesia is also the largest economy of all the South-East Asian markets.

Continuing our series of informative insights as we explore the next wave of emerging markets that are ready to drive digital issuing experiences, I was fortunate to share this Asian leg of our road trip with two esteemed colleagues.

- Pierre Aurel is Stanchion’s Chief Product officer responsible for driving payments fabric, which the organisation has pioneered in recent years. With a blend of both corporate and entrepreneurial background, he is a great asset to have on this market tour.

- Levent Barlas, our Regional MD APAC whilst based in Australia, has been operating in the region within the payments domain for 25 years so he brings a wealth of local insight and connections.

Stanchion has been blessed to have the aegis of the Australian Trade and Investment Commission (Austrade), which is the commercial development agency of the Australian Government. In Indonesia, its Trade and Invest Commissioner is Lauren Adams, who speaks the local language fluently. We have been impressed by the investment AusTrade is making to help businesses succeed in chosen markets and to this extent Lauren and her team organised a wonderful visit for us.

The article below aims to give the reader a sense of what is happening in Jakarta, the capital city, and Indonesia in terms of both economic development and also the local payments industry. To learn more please read on.

One tip for future travellers – we stayed at the Westin Hotel and aside from them hosting the finalists for Miss Indonesia (for the Miss Universe pageant) whilst we were there, the hotel was one of the best we have experienced anywhere on our trips. Absolutely everything about the stay was ten stars.

First impressions on arriving in Jakarta were amazing. We were impressed with the modern large airport and its efficiency. The overall cleanliness of the city and the lack of visible areas of poverty from the airport to the central district was a surprise. This mirrors the aspirations of the country to reach future developed economy status.

Jakarta has historically been a magnet for investment and migration, which has fuelled rapid urbanisation. The effect of this is unfortunately very busy traffic and this needs to be factored in when planning meetings around the city – it always takes much longer to arrive even over shorter distances.

Economic Growth Plans: Vision 2025

Indonesia’s government is targeting 5%+ robust economic growth for 2025. The 2025–2029 National Medium Term Development Plan (RPJMN) focuses on accelerating inclusive and sustainable growth, aiming to help Indonesia break free from the “middle-income trap” by 2038. Key strategies include:

- Promoting digitalisation and green economy initiatives.

- Advancing electric vehicle development.

- Managing inflation to create a stable investment climate.

- Expanding food and biodiesel production to drive growth.

The first of these is where the agenda is driving digital payment adoption.

The current president-elect has set an ambitious target of 8% annual growth by 2029, reliant on increased investment, export expansion and industrial “downstreaming” – which is the processing of domestic raw materials to boost value. Challenges to the growth aspiration of course remain, and these include the current trade tariffs levied by the USA, and a possible dampening of domestic consumption owing to a shrinking middle class and sluggish wage growth.

In terms of Jakarta’s investment outlook, the city remains the economic powerhouse and key destination for foreign direct investment (FDI), even as global FDI flows decline, Indonesia is outperforming. The city is actively improving its regulatory environment to support its vision of becoming a “Jakarta Global City”. This, in turn, drives infrastructure projects, such as the Jakarta Sewerage System, aimed at enhancing urban sustainability and to attract international investment partners.

Indonesia’s Retail Payments Industry is surging, especially in digitalisation

Indonesia’s payments landscape is undergoing its own rapid transformation, driven by government support, central bank deregulation and technological innovation. Digital payments – including online transactions and mobile wallets – are experiencing explosive growth. The Quick Response Code Indonesian Standard (QRIS) has achieved a 170% year-on-year increase in transaction volumes, which helps a shift towards cashless transactions, especially among younger consumers. There is still much to be done but the start is impressive.

The QR Initiatives run on the Account-to-Account rails, so merchants receive immediate settlement and even more impressively, regionally the QR code programmes are interoperable. This allows Indonesians to travel to, for example, Thailand and still pay with QR.

The rapid adoption of QR has arguably stunted the card market. Whilst annual card growth remains impressive, the reality is that the use of QR has been explosive and is used on mobile device, so it appeals to a population that often owns two phones like in many parts of the Middle East.

Indonesia’s card payments market saw card payment values grow 19.5% in 2023 to reach about $66 billion. This growth is attributed to:

- Government and central bank initiatives promoting cashless payments.

- Increased consumer awareness and merchant acceptance.

- A gradual but steady shift from cash to electronic payments, accelerated by the pandemic.

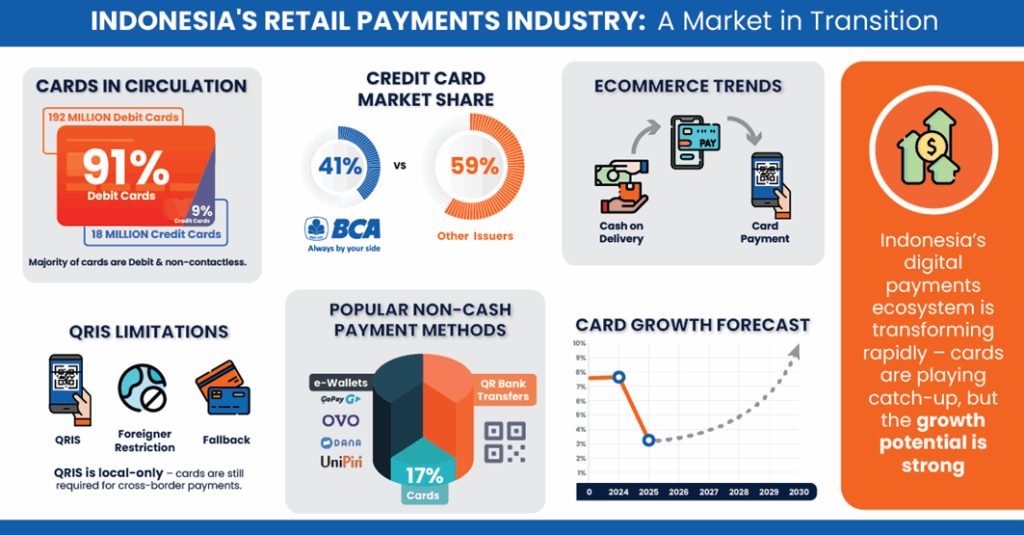

There are 210m cards in issue, mostly debit cards, which are non-contactless in nature, additionally there is no prepaid market under current regulations. Of this about 18m credit cards are issued in market with the largest issuer being BCA with a 41% share of purchase value.

Despite the excellent QRIS solution, as a foreign visitor the scheme is not available to use, so cards or cash remain the way to pay and for Indonesians who travel outside their interoperable markets for QR they too need to use cards.

Owing to the popularity of QR bank transfers and e-Wallets (such as Go-Pay, Ovo, Dana and Unipin) these make up the larger share of non-cash payments, but cards still hold a reasonable share at around 17% and growing, especially for eCommerce transactions, which today is a cash on delivery model. Despite this, Indonesia still has a relatively low card penetration rate compared to many countries so there is a good growth trajectory in the mid-term as the country chases its developed market status. That said, the 2025 forecast growth rate for card usage is 3.2% building on 7.8% growth in 2024, whilst this short-term dip rectifies itself with CAGR (compound annual growth rate) of just below 10% through to 2030.

In terms of the schemes, the local domestic debit scheme has grown fast. It is called GPN (Gerbang Pembayaran Nasional) and is cheaper for local banks to use than the international schemes. There is a local credit card scheme KKI (Kartu Kredit Indonesia) and a wide range of schemes used in the market such as AmEx and UnionPay. The dominant schemes, however, are Visa and Mastercard which appear to have similar market share.

Digitalisation, Tokenisation and Virtual Cards

Payment digitalisation is a top priority. The Bank Indonesia Payment System Blueprint for 2025–2030 outlines a roadmap for further integration of digital and biometric authentication, AI-driven personalisation and enhanced security. Banks themselves are replacing traditional branch structures with self-service kiosks and modern layouts.

Key trends include:

- Mobile Wallets: Services like GoPay, OVO and Dana dominate, leveraging QRIS and biometric authentication to boost user confidence and convenience.

- Virtual and Digital Card Issuing: Banks and fintechs are rolling out virtual cards for online shopping and digital wallets, catering to Indonesia’s tech-savvy population.

- Card Tokenisation: Increasingly, and despite the absence of the major X-Pay Wallets, physical card data is replaced with secure digital tokens, reducing fraud risk and enabling safer mobile and online transactions.

- Crypto and Blockchain Integration are in vogue and are therefore making inroads. New regulatory frameworks supporting crypto exchange-traded funds (ETFs) and fostering innovation in financial services despite being volatile and having cybersecurity concerns.

Indonesia has about 64 million SMEs, of these 37 million merchants now accept QR code payments, which were first introduced in 2017 but exploded during the pandemic. Only two million merchants currently accept card payments but the forecast by Ingenico, the largest POS provider in market, is that this will grow to 7 million.

Powering Indonesia’s Payments Evolution with Stanchion

Indonesia’s payments ecosystem is at a pivotal moment. While led by QRIS, which locally has revolutionised financial inclusion, banks now face a stark reality: their traditional dominance could easily fade. New entrants like Digital Banks and Fintechs that can launch new propositions fast will mean that Banks, whilst still having a few years brand moat on their side will see that runway shorten. Survival depends on bold, technology-driven transformation. To compete in a mobile-first future, financial institutions must rethink their strategies — moving beyond legacy systems to embrace agile, interoperable digital payment solutions, that are broader than just QR. This is where Stanchion’s Payment Fabric provides a key advantage. Our modular and adaptive technology bridges the gap between legacy banking infrastructure and next-generation digital payment experiences. By enabling This is where Stanchion’s Payment Fabric provides a key advantage. Our modular and adaptive technology bridges the gap between legacy banking infrastructure and next-generation digital payment experiences. By enabling seamless integration across banking platforms, card networks and digital wallets, we empower financial institutions to innovate at speed, optimise costs and deliver the frictionless digital experiences that modern consumers expect.

To remain competitive, banks must invest in robust digital infrastructure, forge strategic partnerships and prioritise customer-centric solutions that match the convenience of mobile money. With a global footprint and deep APAC market expertise born from successful case studies in Oceania, Stanchion is uniquely positioned to support this transition — helping banks build scalable, future-ready payment ecosystems that align with Indonesia’s dynamic, mobile-first economy.

Stanchion is ready to collaborate and shape the future of payments with Indonesian Banks and Fintechs.

Following a successful mission, which has identified a couple of attractive local partners for us to work with, we aim to be back in the region before the Singapore Fintech Festival as well as being at festival in mid-November.

Reach out and explore how Stanchion can accelerate your digital transformation in region.

Verto

Verto Switchcare

Switchcare Professional Services

Professional Services